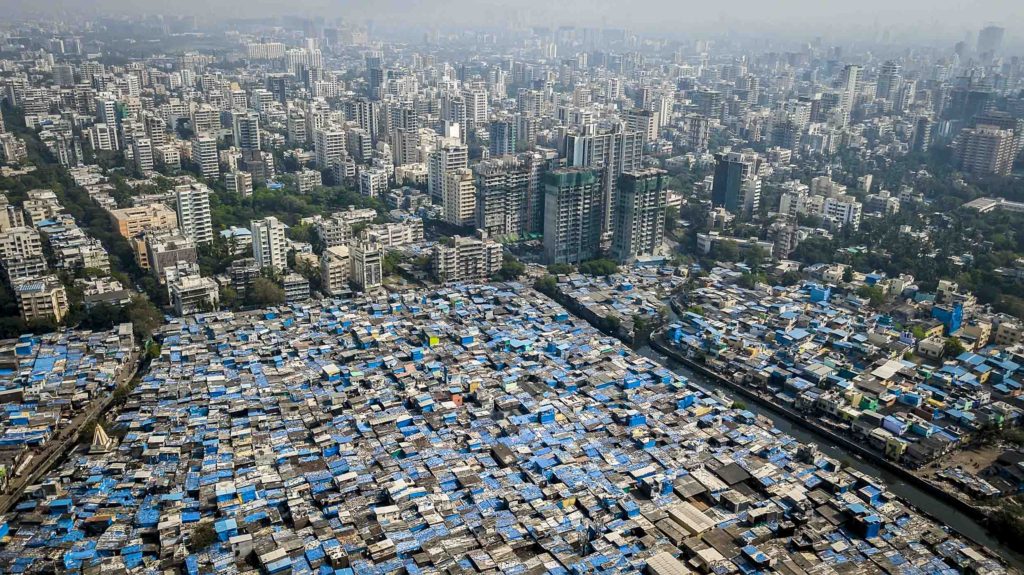

Mumbai sits on some of the most expensive real estate in the World. Above, photographed by a drone, are slums, with some of the poorest city dwellers amidst skyscrapers and concrete blocks with mega- industries and the homes of the super-rich. Mumbai is a city where dreams are made, and it is also a sprawling metropolis with stark inequality. The visible development is also a sign of development and business opportunity.

LARGE SCALE case

Business Cases and past examples give important insight and a learning template for Companies looking to invest and do business outside their comfort zone. Please note that no case study is to criticize or to find any fault with any Company. We have great respect for all organizations and any business development is a complex process and new business takes courage, determination, and there is always an element of luck and destiny. However, market research, due diligence, and project execution are important factors to realize any success. The case examples below are merely for information and for the purpose of knowledge and learning.

Daiichi Sankyo, a large Japanese Pharmaceutical Company, and Ranbaxy Laboratories, an Indian Pharmaceutical Company, is one of the largest failed Japanese investment and acquisition case that involves India and Japan. In June 2008 Daiichi Sankyo invested in Ranbaxy, one of the largest generic drug manufacturers from India, for a sum of approximately US$4.6 billion. Soon after the acquisition, Ranbaxy`s factories were under suspicion and being audited by the US Food and Drug Administration (FDA) for submitting fraudulent quality data, and all imports were subsequently stopped. Ranbaxy was accused of developing the generic drugs without the required protocols, safeguards and quality controls, and a whistleblower reported these violations to the FDA.

Daiichi Sankyo acquired Ranbaxy because generics and bio-equivalents of brand name drugs is a big scale and profitable business. You can manufacture at a low cost and sell for very good profit margins. An estimated 40% of America’s generic drugs at the time came from India. Additionally, almost 80% of active ingredients for drugs in the United States, for both brand name and generic drugs, are either from India or from China, so Daiichi Sankyo saw Ranbaxy as a huge opportunity to diversify and grow the business.

As per media reports, Ranbaxy was acquired by Sun Pharma, another prominent Indian Pharmaceutical Company. As a part of the deal, Daiichi Sankyo received a stake of 8.9% in Sun Pharma, and later sold these shares for US$3.6 billion, upon exiting the Indian market. In financial terms, Daiichi Sankyo was able to recover most of its sunk cost in the overall business deal. However, Daiichi Sankyo had a sunk cost which was not well-utilized for business growth, and though mostly recovered, Daiichi’s biggest loss here was time, human resource and the opportunity cost of capital.

Daiichi Sankyo’s investment into Ranbaxy was at a time when investor sentiment in emerging markets was high. And Daiichi Sankyo may have rushed into the deal overlooking many important and vital details.

It is clear that although some information may have been hidden from them, or may have not been clear, Daiichi Sankyo did not do their due diligence properly with regards to 1. Repeated Factory inspection and detailed testing of the active ingredients in generic medicines, and the end -products being exported to the USA. 2. There was a major lack of frequent and detailed communication with the FDA (Food and Drug Administration) to follow up on compliance and on consumer reports in the USA. Daiichi Sankyo did not seem to have a clear objective and as an afterthought, they missed many situations that would clearly highlight that something is not right. The whole transaction was a failure in Managerial Due Diligence.

Moreover, the dispute between Daiichi Sankyo and Ranbaxy resulted in confusion with regards to responsibility, and this made matters worse and prolonged the whole debacle.

Daiichi Sankyo may have been able to avoid the unfortunate circumstances if they took more time to conduct managerial due diligence and more detailed legal checks and testing of generic drugs being manufactured, based on specified bio-equivalent specifications.

Another well-known business case that ended in a bitter legal dispute was NTT DoCoMo`s 2009 investment in Tata and Sons (a large Indian business conglomerate) telecom division, Tata Teleservices. After things did not work out, NTT was promised approximately US$390 million out of its total initial US$2.2 billion investment to take a 26% stake in the business joint venture. As per the parting agreement, NTT DoCoMo was handed US$390 million, and additionally, they were also given a balance of about US$790 million, which would have to be invested in expansion projects or joint ventures in India. NTT DoCoMo was barely able to recuperate little over 50% of its initial US$2.2 billion investment.

These are two large scale complex business dealings and we can try to learn from them.

GENERAL OVERVIEW

Some companies are too slow in developing a strategy and therefore they lose the window of opportunity to really do something. In the past years, they had been too busy with investments and resources on business in China, Indonesia, and elsewhere, and with their home-based customers. However, competitors and the Market do not wait for you. It is for you to develop and to approach it with an intention to create the opportunity.

The market may be limited for some companies

India may be a huge market based on population, but for most Japanese products, the actual market size is relative to each market segment. For example, ROYCE (chocolate) & YOKU & MOKU (Confectionery) are in India, however, they are specifically targeted and priced for a growing niche upper-class market. MUJI has also entered India. MUJI is doing a lot of localized test marketing and even after developing some local sourcing, MUJI India’s prices will largely be catered for the higher upper-middle class. The majority of Indians still cannot afford these brands, and they may seek other local alternatives.

Therefore, market sizing, pricing, a clear understanding of the target market, and developing an effective marketing strategy need to be done well. It is good to spend some money here as you devise how you can utilize a business network and strategy to approach and to narrow down on the market. Once you decide to go to market, you want to set up your business quickly, and with more in-depth localized knowledge.

Why Maruti Suzuki succeeded

Suzuki entered India early, at a crucial time when the automobile and passenger vehicle market in India was very nascent. The stately Ambassador, made by Hindustan Motors and the Premier Padmini (under license from Fiat) were some of the more visible models on the road. Other than that, one would mostly see bicycles, rickshaws, scooters, motorcycles, trucks, and busses. And yes, even lots of cattle. Cars were for the well to do, and foreign brands had not made a big entry into the Indian market.

In the early 1980s, as a personal project overseen by Sanjay Gandhi, the son of Indira Gandhi (of the Nehru-Gandhi family), Maruti Suzuki received favorable treatment which included access to low-interest capital and subsidies. As a preferred supplier with easier access to local resources for indigenization, the vision to develop a mass-market vehicle was realized. To add to this, they received some protection due to the lack of any foreign competition. By the time the market was open to competition from abroad, Maruti Suzuki was ready to capitalize and build on this opportunity. With the Maruti 800, they built a 796CC hatchback small-car, that perfectly met the needs of the Indian consumer.

Suzuki focused on the small car market and developed durable yet fuel-efficient and affordable models. Parts were widely available in every corner of the country, at modest prices, and Suzuki worked well with local suppliers and partners. In fact, they developed local sources over time, and this has been key to their overall success, and also to the success of their sourcing partners, who were able to expand and become large global automotive suppliers.

The factory also had very high capacity utilization levels, which was optimized to meet the large scale market needs of developing India.

Suzuki raised its stake in Maruti Suzuki to 56% in 2013, and India can be regarded as its most successful market. It is also one of the most recognized brands in India today, with a very high market share.

After Suzuki, the Korean brand, Hyundai also makes smaller mass-market models that are priced well, with an effective marketing strategy. They make all-inclusive model cars with critical important features built-in to the base price, because they know Indians expect certain things all-included and not optionally priced. Hyundai is reliable and the designs were well appreciated by the Indian customers. Hyundai also has a high market share after Suzuki and for Hyundai, India is also a market where they make vehicles for exports abroad.

As Suzuki is weak in “connected vehicles” and “electrification technology”, Toyota will be a major technology partner to Suzuki in India. Toyota will likely take a larger and more active role in India, and they will help transition Suzuki for the future of Indian e-mobility.

How to solve an issue (cost reduction)

Examples

- A machine manufacturer company A sells the bare minimum machine, with critical precision component assembly from Japan to a customer. The fixture design and the fixture/ jigs manufacturing are done by a local company in Bangalore and the automation is done by a company in Pune, India. A complete turn-key solution is sold to the OEM buyer in India, utilizing the strengths of both countries and better cost management. This is possible and it is being done.

- A trading company B imports German machines, brings the critical precision components from Germany and buys less critical components in India, or Japanese components and electric units available and distributed locally in India. They assemble the entire machine in India. Also, all the machine try-out, commissioning and servicing are done in India, so this saves greatly on hotel cost, back and forth travel cost of engineers, and the long-term costs of marketing equipment.

- Consumer goods company C makes its supplies in or in South East Asia, and they market through an Indian partner in India to reduce the cost. The material costs can be just as reasonable from South East Asia or China, however, there is a risk of FX (Foreign Exchange) fluctuations and political risk in this strategy, as economics policy may change, but it could be the first step before rolling out local production/manufacturing in India.

- Understand local market needs, and manufacture a product specification for the Localized Indian market and for neighboring markets. This is a smaller and more specified approach to build your Company’s brand locally, and this may also allow you to protect your know-how by starting with 1-2 smaller projects, and then grow gradually. The local specification can be developed by speaking to industry and marketing experts on the field in India, and by conducting good market research. The R&D can be done in Japan, and with approved drawings, the product for Indian market specifications can be partially made and fully assembled India.

Each methodology above requires a trusted partner and a long-term approach in business. However, the cost merit transferred to the end customer can make you win in the local market, and it will also improve the marketability of your brand in the local market.

A key point is that India should NOT only be seen as a stand-alone market but with the new ‘Make in India’ government policy and initiative, India should be used as a local export base for several countries such as the Middle East, Africa, Sri Lanka, the United States, and Europe. The wider approach, to utilizing manpower, the talents and the democratic benefits of India, but with a focus beyond the Indian market will allow for better risk hedging and a more balanced strategy.

As an example, Daikin India makes Air Conditioning units in India. However, based on value addition in the Indian market, they also develop and manufacture for markets in the Middle East and Africa. This is a “Make in India Plus Strategy” for better risk management and better utilization of company resources.

8 Important Takeaway Points to increase your chance of success in India:

- Focus on your own strength

- Know your competition (foreign and local)

- Have a clear vision of what customers want

- Plan your go-to-market strategy

- Utilize a good local partner (build trust)

- Conduct legal, and financial due diligence of the Partner, but most importantly, Managerial Due Diligence to truly know the business partner – “the people”

- Make the solution available locally, or localize and manufacture a specification more fitted for the local market

- Lastly, localize in India, but also view India as a market to globalize, utilizing the Manpower, youth, and skills present in India.

India has a young working population with many trainable and talented engineering graduates. It is a large market with a sizable developing population. Importantly, the County is a democracy with a focused vision by the government to make India a major player as a global manufacturing hub. There are challenges, but the vast local market and the talent is there to make this vision a reality.

Very few Japanese companies work effectively to create localized solutions to succeed abroad. They focus on Japanese companies as a partner or supply products and equipment that are too expensive for a price-sensitive growing economy.

They do not localize their marketing efforts enough to really compete in India, despite the fact that the Japanese have the technology and capital. Some fear that their know-how might get stolen or they may get cheated. These concerns are valid, but some risk hedging and utilizing local resources can protect Japanese business interests as they plan and execute for the long term.

Lastly, the fear of communication and particularly English leads to not employing the best or most suited manpower for a project for India. Just because someone speaks English does not mean that they will have the most effective communication ability to deal or execute business.

It is important to remember that English is only a tool of communication, it is not business.

Japan and India surely have a lot to share and to benefit from each other. Indian manpower and skill, Japanese discipline and technology, two great cultures, can build bridges that will help both economies gain.